Mind the gap: How banks have neglected the self-employed (and how to turn it all around)

A personal banking account or a small business banking account: Which one should a freelancer choose for their business? What about an entrepreneur or a consultant? Small business owner?

This shouldn't feel like a trick question, and yet for the 57.3 million self-employed professionals in America, the right answer is elusive. For the most part, neither account is the right fit. Personal banking lacks basic business management tools, and business banking is unnecessarily complex, leaving the "solopreneurs" in a banking no man's land.

This isn't meant to be a blame game. Truth is, up until recently, banks didn't have a strong motivation to cater to this segment. Self-employment used to be an arrangement of necessity, not choice, with business longevity being the primary cause of concern for banks.

But the economics of the labor market have changed drastically in recent years. People are choosing to be self-employed, and though their ambitions to grow into a corporation are unclear, their profitability is not. The number of high-earning freelancers ($100,000+) has grown 15% since 2014, and a study by Harvard & Princeton suggested that in ten years, self-employment will outpace traditional salaried work. So, where does that leave banks?

The cost of businesses hiding in personal banking accounts

The traditional lines of business in banking need a shake-up. A survey conducted by Research Now earlier this year revealed that 51% of self-employed Americans, and 32% of American small business owners with less than five employees are using personal banking accounts exclusively for their business transactions. The implications of this are huge.

1. It means that entrepreneurs aren't getting access to the tools and financing that they need to manage and grow their business. Their failure hurts the bank's bottom line, not to mention our economy.

2. It means they're looking for solutions elsewhere. Again, not great for banking profits.

3. It also means businesses are hiding under the bank's nose—up to 30% of personal account holders—and when they're ready to upgrade to more lucrative banking products or accounts, they'll probably take their, for a lack of better words, business elsewhere.

Busting the unprofitability myth

If the segment's sheer volume isn't reason enough for banks to pay attention to them, here's another finding that changes the narrative:

Of the self-employed professionals using personal banking accounts for business transactions, 11% have a yearly business income of more than $75,000.

These are not your stereotypical "gig workers" hiding in personal accounts, fighting for their next pay check. They're profitable consultants; freelance software developers; startup executives. Far from being unable to "afford" premium banking solutions, these findings suggest a more probable explanation: they're not incentivized to make the switch.

And since personal banking isn't addressing their business needs, they're looking for help elsewhere. Studies from Javelin Research back this up, citing the self-employed as the most "at-risk" segment. They churn at double the rate of salaried personal banking customers and are more likely to have multiple banking relationships.

©2019 Javelin Strategy & Research

Though there isn't hard data about why they prefer to stay within consumer banking, Barlow's Research into The Banking Behaviors of Micro-Businesses in the U.S. reveals a crucial insight: The self-employed don't see their bank as a centre of influence when it comes to their business.

When asked where they sought business advice, only 16% said they went to their bank. The vast majority (74%) cited their accountant. Accounting plays a critical role in all stages of a business' life, but it's make-or-break in the early days. So, it comes as no surprise that some of the biggest players targeting the self-employed and small business segment with financial management solutions are, in fact, accounting platforms.

Third party providers disintermediating banking relationships

Accounting companies offer accounts payable, accounts receivable, bookkeeping, expense capturing, and other task support specifically targeted at the self-employed and small businesses. The giants like Sage, Xero, and Intuit have also integrated banking services into their offerings.

LendingClub, Kabbage, Tide, Paypal, iZettle and other fintechs now offer instant credit for SMEs, while ERP software providers like SAP are integrating cash management into their offerings to help corporations lower working capital.

Of course, there's also the slew of neobanks flooding the space, vying to fill the gap left in the market by banks, with mobile-first solutions tailored for the self-employed, addressing both their banking and "non-banking" needs.

These companies threaten to turn banks into "dumb pipes"—in other words, commoditized financial storage units from which funds are debited and credited, with minimal business-to-bank interaction.

Turn the ship around: From provider to partner

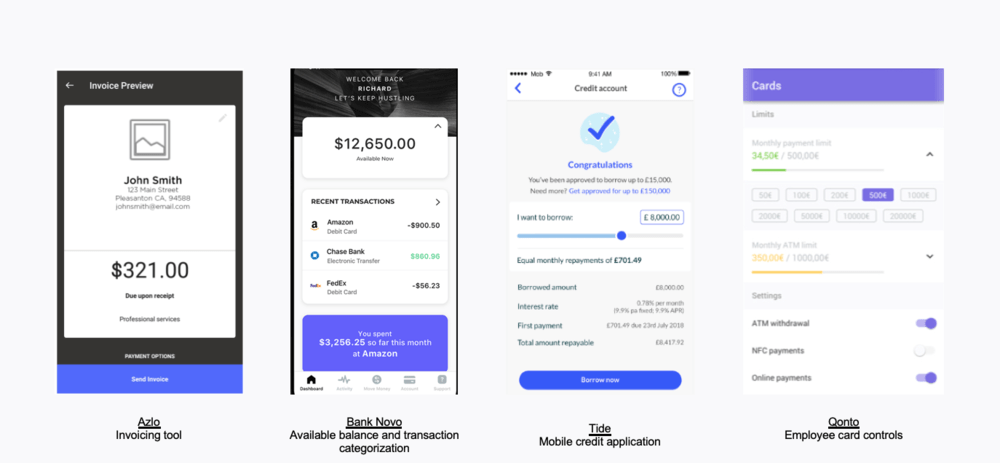

On the bright side, there's a lot banks can learn from the competition. Neobanks provide a vision for what a self-employed banking proposition should look like in a mobile-first environment, with sleek and simple design, useful search tools, integrated financial management solutions, and compelling data that provide insight into the business.

For banks with a large pool of freelancers and growing businesses operating on their consumer banking platform, the opportunity to offer low-cost, pared down business features that help them get their business off the ground is a unique retention and acquisition play. Indeed, retaining them at this stage presents a (lucrative) long-term opportunity to ease the transition to a small business banking package.

I'd be remiss if I didn't mention lending being a critical part of the proposition—small business owners’ biggest beef with financial institutions—but I'd also be missing the point. Companies need capital to grow, sure, but they also need tools to manage their day-to-day. Bill pay, invoice and expense management, and other financial tools that are considered "not core to banking" must be part of the proposition.

This is a key turning point for digital banking, and the winners will recognize that this segment is a golden opportunity to put their best foot forward. Banks need to start thinking about how their digital channels can be used to demonstrate the role they play as a financial partner in the personal and professional lives of their customers—not a mere provider.

At the risk of stating the obvious, value needs to be at the core of every offering. Is the solution helping the end-user manage and grow their business? Is it solving a problem better than competitors (i.e. both banks and third party providers)? Is it cheaper? Is it easier to use? Does it integrate better with the rest of their financial ecosystem?

For 2019 digital strategy recommendations, register for our webinar with American Banker and Javelin Research & Strategy on March 6.

Header image created using Creative Common assets from Pablo Stanley.