The June Barcode: Consumer travel spend during the pandemic

Image credit: Sensibill

The Barcode Report delivers the world’s deepest and most relevant insights on everyday consumer spending. We break down spend data into digestible and actionable facts, highlighting key trends that go beyond what you’d learn from simple card statements. We leverage item-level receipt data accumulated from millions of users across our network of banks, credit unions and technology partners. The Barcode dives beneath the surface of “how much was spent and where” and provides a true look at what consumers and small businesses are spending their money on.

In this report, we’re focusing on consumer spending insights from travel spend during the pandemic.

Key Highlights & Takeaways

Travel Consumer Spend in the US increased by 121% since the onset of the pandemic

Ever since the onset of the pandemic, there has been a slow down in travel. However, in the US consumer spending on travel saw a spike during the same period.

Luggage related expenses declined by eightfold in the US

Since people are traveling closer to home, consumers no longer need to spend on luggage and baggage carriers. Luggage-related expenses have declined by 8 folds since the pandemic.

Lift needed, in terms of a lower number of new COVID cases, to increase travel in Canada is 4 times that needed in the US

While everyone is sitting on the edge of their seats to start traveling, in the US, the nudge needed to start traveling is much less than that needed in Canada.

The pandemic did not deter people from traveling

As expected, travel-related average spend during COVID declined by 46%. However, when we looked into the average spend by item categories by region, we saw the overall average travel expense increased in the US by 121% while it declined by 86% in Canada over the same time period, despite a higher rate of infection per capita in the US than in Canada.

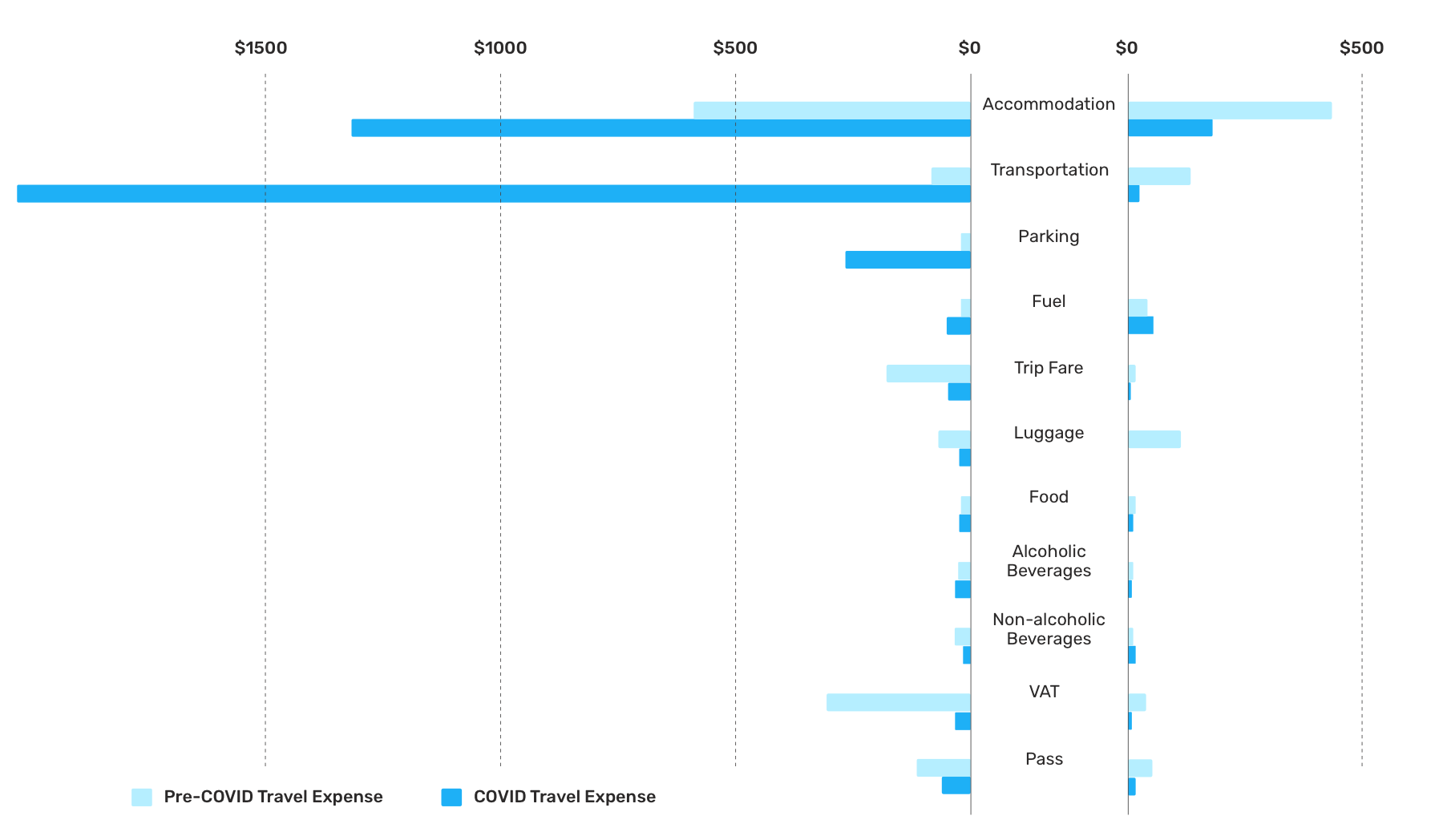

Change in travel expense in Canada and the US

Source: Sensibill Data Lab

Traveling closer to Home

When we looked more closely at the type of travel spending in the US, we were able to break travel spending down to show an increase in travel-related accommodation expenses threefold, increase in travel-related transportation expenses fourteenfold, increase in travel-related parking expenses twofold accompanied with the decline in luggage expenses by eightfold, pointing us to the fact that consumers in the US were still taking breaks and vacations, just closer to home.

Average spend per person in each travel category

Source: Sensibill Data Lab

Varied travel reaction to the pandemic across North America

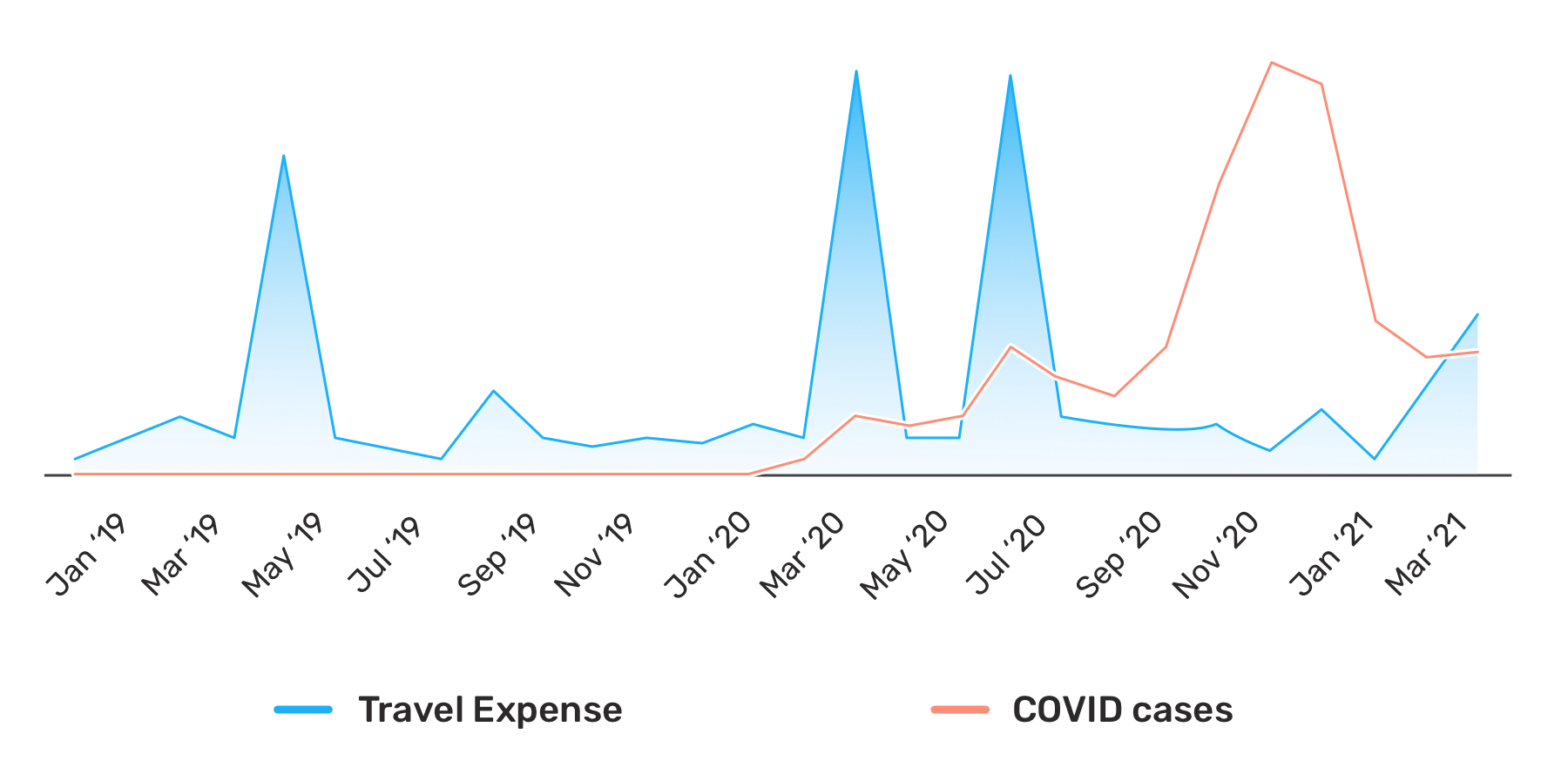

We overlaid the everyday spend data from consumer receipts with publicly available data from Our World in Data about COVID infection to see how strong of a relationship in consumers’ minds between pandemic risk and travelling. In the US, in January of 2021, a 4% decrease in new COVID cases led to a 183% increase in travels while in Canada, during the same time period, a 2% decrease in new COVID cases brought about an increase of only 21% in travel.

While COVID infection rates have had a direct impact on travel, the overall reaction to travelling is indeed varied greatly across the North American region.

Trend average travel expense in the US (Jan 2019-Apr 2021)

Source: Sensibill Data Lab

Trend average travel expense in Canada (Jan 2019-Apr 2021)

Source: Sensibill Data Lab

P.s. Subscribe here to get the Report to your inbox every month 😏