Sensibill Demonstrates Value of Digital Engagement with Tier One Bank

About

The Bank is one of the top three largest consumer and commercial banks in the United States by total assets.

The Bank has a proven reputation of delivering seamless digital tools to its customers, empowering them with flexibility and choice to bank where and how they prefer. The Bank serves nearly half of households across America with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing.

Challenge

The financial services landscape continues to grow increasingly crowded, with mounting competitive pressures from both incumbents and emerging fintechs. Research from The Financial Brand reveals that almost three-quarters of financial services executives surveyed thought that at least two fintech or big tech firms will be a top ten financial institution provider (in terms of assets) by 2030. This is why The Bank continues to place a significant priority on technology, investing billions of dollars per year into its technology roadmap and strategy.

In response to these competitive threats, The Bank has been laser focused on driving meaningful customer interactions within mobile channels. The Bank set out to boost digital engagement and reduce customer attrition by increasing mobile logins, diversifying the types of activities and transactions completed in app, and prolonging the duration of mobile sessions.

Solution

To help accomplish this goal, The Bank set out to create a comprehensive ecosystem of valuable financial tools and capabilities that would effectively engage customers and differentiate the digital experience. One area that customers repeatedly demonstrated interest in and appetite for was sophisticated receipt management.

After evaluating many options for receipt data collection and management, The Bank selected Sensibill due to the fintech’s proven success with bank partnerships, including its strong security standards, data integrity and regulatory posture; the quality and accuracy of its data extraction capabilities; and Sensibill’s flexibility around implementation and ability to create a cohesive user experience.

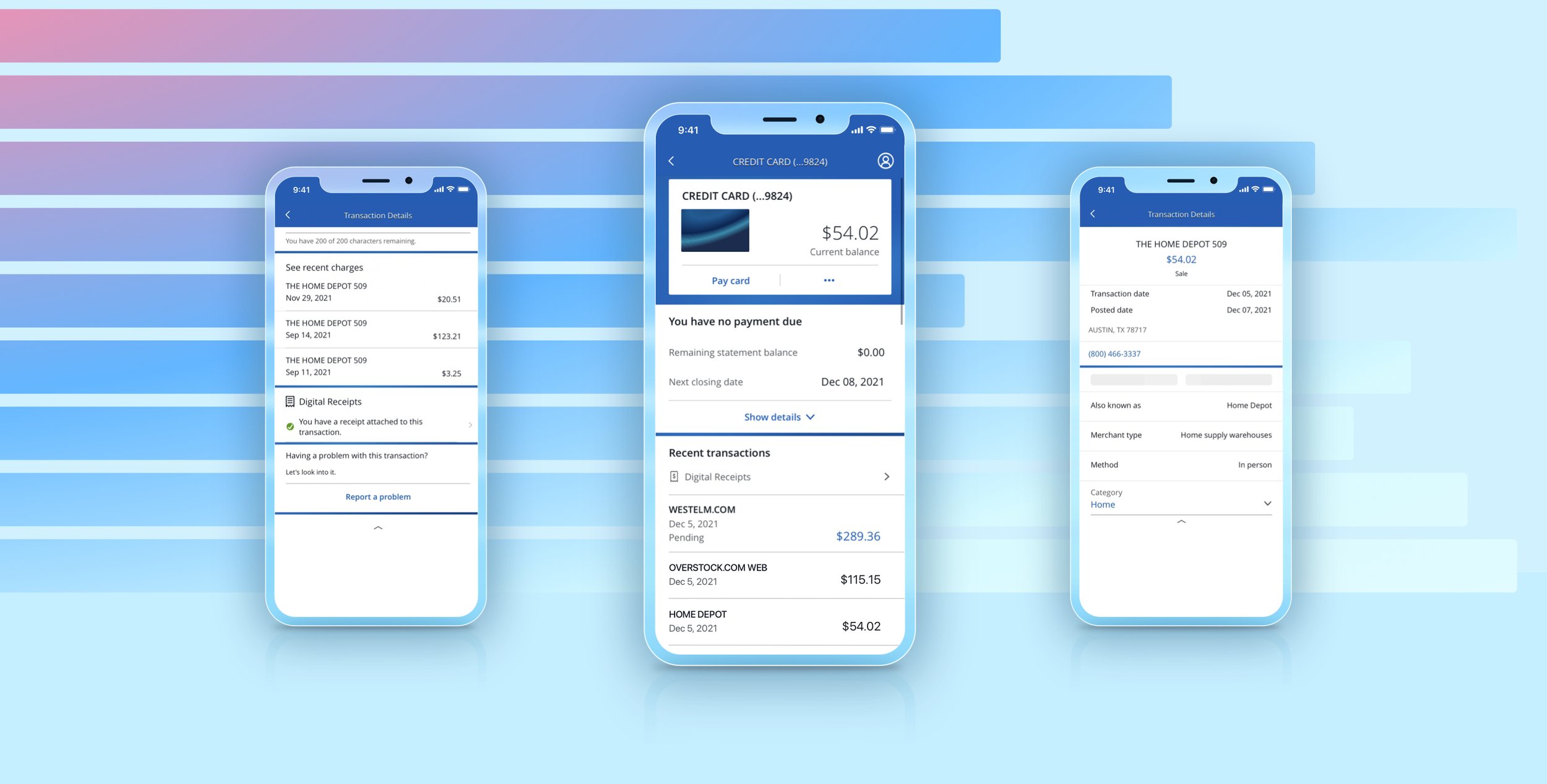

In mid-2020, The Bank added Sensibill’s digital receipt and expense management solution within its mobile banking app, making the service available for consumers as well as businesses. With Sensibill, The Bank’s consumers can:

Better track spending and manage their finances by digitally capturing, storing, and organizing receipts.

Automatically reconcile receipts against transactions, providing unparalleled visibility into spending and buying patterns.

More easily make returns and submit warranties.

Business customers also gain significant benefits through Sensibill’s technology. They can:

Reconcile receipts to transactions, more easily separate personal and business expenses, and submit expense reports more quickly, expediting access to funds.

Enter tax season with greater confidence, reducing the hassle and headache typically associated with sorting through paper receipts.

Results

The solution was made available to all of The Bank’s consumer and commercial customers by October of 2020. Through strictly organic growth (no proactive marketing or promotion of the new service), digital receipt volume exceeded original annual targets by 275% in the first year, ultimately creating a new source of customer permissioned first party data.

Users that leverage Sensibill’s technology have proven to be significantly more engaged with The Bank within digital channels, supporting The Bank’s primary goal of strengthening loyalty and reducing churn. For example:

Engagement

Sensibill users log in 3.8 times more than those who do not use digital receipts

Loyalty

After the adoption of Sensibill, customers log in to the mobile banking app 52% more than they did previously

Value

Sensibill users upload a receipt during 32% of their mobile banking sessions

Sensibill users have nearly double the number of products with The Bank than their non-receipt using counterparts.

In addition, Sensibill users are more profitable; they have nearly double the number of products with The Bank than their non-receipt using counterparts. Adoption of the service saw strong growth into 2021. The number of champion users increased by 130% and users uploaded 114% more receipts from Q4 2020 to Q1 2021.

Lessons Learned

The Bank established several best practices along the way which allowed them to experience such strong engagement and adoption. Lessons learned include:

The importance of creating a highly intuitive user journey in-app.

The Bank prominently displayed the Sensibill tools in a relevant location - within transaction history on the home screen - increasing organic discovery and allowing users to easily access the functionality. As a result, over the past year The Bank experienced an average growth in monthly adoption of 23%.

Reduce friction whenever, wherever possible

The Bank did not require additional authentication for customers to access digital receipts, boosting engagement. Removing barriers to single sign on have been proven to support organic growth.Supercharge the transaction matching experience

The Bank has enabled users to seamlessly link a receipt to a transaction after the receipt is uploaded. In this second entry point to transaction matching, Sensibill's technology can intelligently detect receipt line item details and suggest multiple transactions that most closely match the data, making the overall user experience quick and easy.

Receipt capture and storage is just one part of understanding and managing expenses. Moving forward, The Bank plans to implement more features to assist users in the expense management journey, providing greater utility and creating more value.

As a leader in the financial services industry, The Bank is always looking for ways to provide additional benefits to customers, interacting with them in meaningful ways that drive digital engagement and create exceptional experiences.

With Sensibill, The Bank is effectively leveraging the power of leading digital receipt and expense management technology to do just that.

Sounds interesting?

Contact us for a no-obligation demo and we’ll be happy to show you our latest products.