Sensibill announces new Sensibill Platform, featuring Spend Manager and Spend Insights

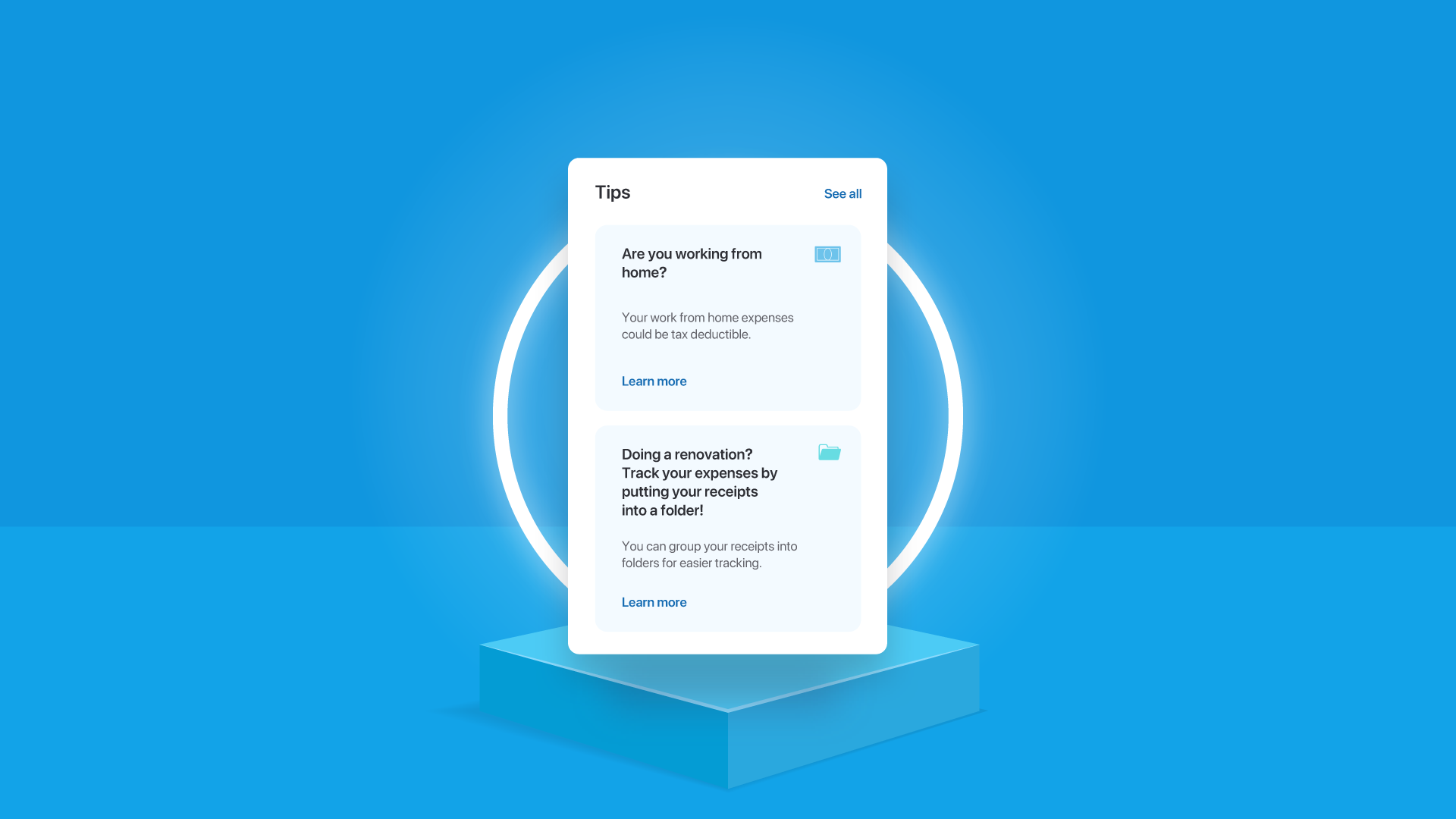

Image credit: Sensibill

The Sensibill Platform gives financial institutions the deeper data and insights they need to better serve and nurture financially resilient, loyal customers.

As a financial institution, serving your customers with the best digital tools, products, and services is key to helping your customers thrive financially. But the question on many institutions’ minds has always been: how?

At Sensibill, we understand that the struggle is real when it comes to truly knowing what your customers need, right when they need it. So we went ahead and created two key solutions that would help financial institutions do just that.

Enter, the Sensibill Platform, which includes two new products: Spend Manager and Spend Insights.

The Sensibill Platform bridges the gap between everyday spend and long-term financial wellness by providing financial institutions with the deeper data and insights they need to nurture financially resilient customers that bank with them for life.

With the Sensibill Platform, banks and credit unions can dive beneath the surface of customer data, right down to the SKU-level, to better understand their customers and finally get personalization right.

With Spend Manager, Sensibill makes tracking everyday expenses quicker and easier, helping end-users build healthier financial habits. Spend Insights takes the SKU-level data collected from Spend Manager and makes it actionable (and powerful). Built on advanced AI and machine learning-driven technology, our new solutions help financial institutions better understand their customers and personalize products and services to them that best fit their unique financial needs.

Corey Gross, Co-founder and CEO here at Sensibill, relates why solutions like the Sensibill Platform are essential to the success of financial institutions:

“Sensibill is empowering institutions of all sizes to harness SKU-level data to offer personalized experiences and recommendations that help make customers’ hard-earned money go further. The time to act is now—by better contextualizing the transaction-level data they already have with SKU-level insights, institutions can help their customers make smarter financial decisions. Those that do will retain loyalty and expand market share while making financial wellness more attainable for all.”

The entire team here at Sensibill couldn’t be more excited and proud to announce the Sensibill Platform, with solutions that will revolutionize the way financial institutions not only understand but nurture truly financially resilient customers. To learn more about the Sensibill Platform and to explore our solutions, let’s talk.