The jobs-to-be-done of receipt management

I’ll be honest: getting people excited about receipt management isn’t always easy; it’s not buzzy or sexy, but to freelancers and small business owners who spend hours a week sifting through receipts at the expense of growing their business, it’s a lifesaver.

As a product marketer, I work with our bank partners to understand and communicate with our end-users. This means knowing how to cut through the noise and position our product in a way that resonates with these users.

Jobs-To-Be-Done

To guide product marketing strategy, I like to align our product messaging with the Jobs-to-be-Done (JTBD). If you’re not familiar with the framework, here’s a good starting point.It’s my priority to understand what our users are trying to accomplish, and what pain points they’re trying to alleviate.

The framework helps orient my team around our end-users’ need(s) - both functional and emotional. It’s rooted in the principle (and old marketing adage) that people don't buy a quarter-inch drill, they buy a quarter-inch hole. In our case, business owners aren’t buying a receipt management tool, they’re buying more time back on their calendar and control over their business finances.

The idea is to reframe how your customers think about your product - away from features and toward outcomes.

Here’s my checklist of JTBD activities:

1. Put user research first

I like to conduct “switch interviews” to uncover all the events leading to the adoption of the solution. These interviews are meant to explore the broad journey leading up to why customers adopted a solution–the struggles they went through, their desired outcomes, and the motivations behind the decision.

Doing this helps us build a “jobs timeline” from the initial thought to the adoption of a solution. Understanding these moments or triggers helps marketers craft cues that nurture customers all the way through to product activation.

Tip: When conducting interviews, keep in mind that people don’t always make rational decisions. Instead of asking them why they chose a product, ask them to recall specific experiences i.e. the last time they filed their taxes. These stories will typically reveal the real and emotional drivers leading up to their decision, which will help with your next task.

2. Outline your end users functional and emotional needs

Just like an applicant for a job, you need to know what the expectations of the job are in order to fulfill them. These requirements can be broken into functional and emotional needs. For example, at a high level, this is what our end users, micro-business owners, “hire” receipts for:

Functional Needs

Prepare and fill in tax forms

Maximize tax deductions

Be compliant with their government tax agency

Monitor cash flow

Send expense reports to clients

Emotional Needs

Save time that could be spent growing their business

Feel in control of their business finances year-round.

Feel their business is protected in the event of an audit

Reduce stress when they’re filing taxes

Feel productive

Save money!

3. Map out the four forces

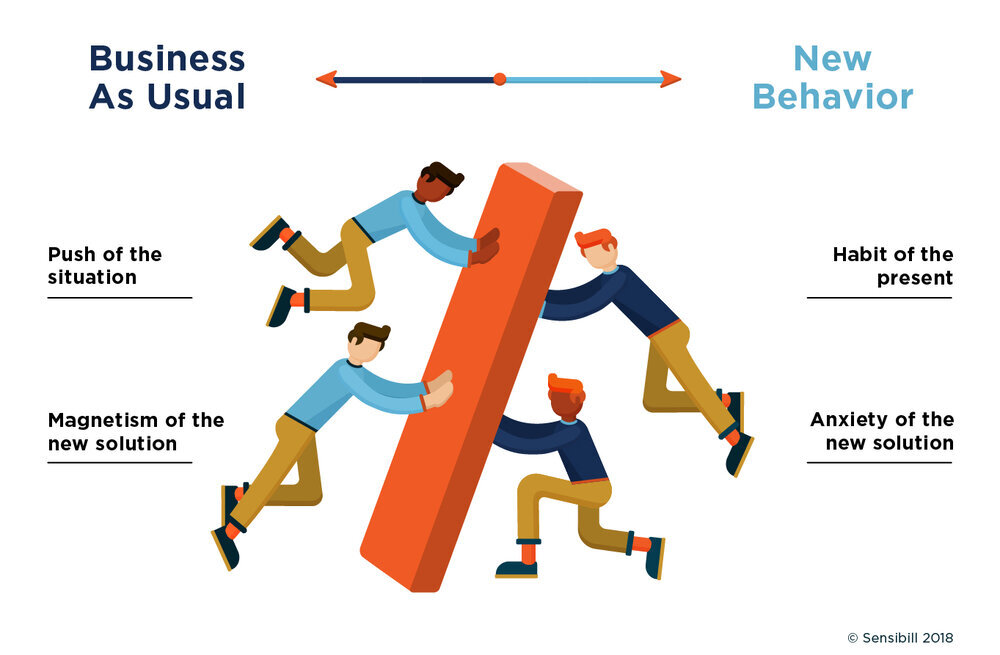

Whether someone is looking to buy a house, switch banks, or start using a new financial management tool, there are opposing forces that influence their decision. According to the JTBD framework, the four forces are the factors that are pulling and pushing your customers towards a new solution, and the anxieties and habits they currently have that are preventing them from making a switch. As a product marketer, it’s vital to not just promote the positive outcomes of your product, but to also assuage any anxiety users might have about adopting new technology.

Concept by: Chris Spiek (jobstobedone.org)

4. Align on language

An aspect of my job is consulting with our bank partners on the go-to-market strategy of our solution and ensuring that they’re equipped with the materials they need to drive maximum adoption. This includes helping them to craft communications to users.

User communications can take the form of push notifications, in-app messages, email marketing, videos etc. It’s key to understand the language that resonates with users, and what kind of language they use to talk about the solution and its benefits.

Tip: When you’re drafting short copy, every word choice counts–and not all synonyms are created equal. User interviews and App Store reviews can reveal which words users describe solutions with. It’s your job to dig into the definitions and connotations of words. For example, if a user describes our tool as “simple”, I need to know why “simple” is important for a receipt management tool. As it turns out, many accounting tools are bulky, overly complex, and require tedious onboarding. For a stressed freelancer trying to minimize time spent on administrative tasks, the word “simple” feels like an oasis.

Using the right language in your messaging could mean the difference between sending out a push notification they engage with and one they ignore.

5. Keep talking to your customers

This checklist shouldn’t be a one-time exercise. It’s an iterative process that requires ongoing research and feedback from your users and/or customers. In our case, this means banks need to talk to their customers and relay that information back to us.

My parting advice...

Fintech vendors,

It’s up to you to be the authority on your product and your end user. In the same vein, it’s on you to deliver the relevant insights to your bank partners in a way that’s easy for them to internalize, and above all, easy for them to implement. This goes beyond just providing them with personas or use cases, but also giving them adoption playbooks that are tried and true. (In other words, pick up some of the heavy-lifting!)

Banks,

Build your mobile banking suite with the intention of helping customers more effectively and efficiently complete a job from start to finish. Evaluating and marketing your products using the JTBD framework will help you provide value-added experiences for your customers–and even identify why some products failed. Your evaluation process should revolve around helping customers achieve their desired outcomes, or you risk being fired for a third-party solution or worse yet, another bank.