How digital receipts can drive personalization for banks

This is a syndicated post. You can find my original post on LinkedIn 2016-11-29

43% of customers believe their primary bank does not understand their needs. (Cisco, 2016)

We’ve all come home to stuffed mailboxes filled with offerings for a card we already have, or for a mortgage we don’t need. At best, people toss the mail in their bins. At worst, a steady stream of irrelevant offers will upset the bank-customer relationship permanently.With the promises of Big Data, uninformed offerings seem surprising. But Big Data presents big problems for banks, who can be paralyzed by internal silos and dated marketing approaches.Although accumulating new sources of customer data (i.e. geolocation or social media activity) seems like the road to customer-centricity, financial institutions know that the real solution lies in leveraging existing information-rich data assets in greater depth. When applied properly, a small number of data streams can yield greater business value at a lower cost than vast volumes of data. The challenge for banks is prioritizing these data assets.In the case of personalized banking, zeroing in on purchase data would drive significant business value, as well as customer value, at a much lower cost. To do this, all banks need is access to customers’ digital receipts.

Get to know your customer by diving deeper into purchase data

1

2

3

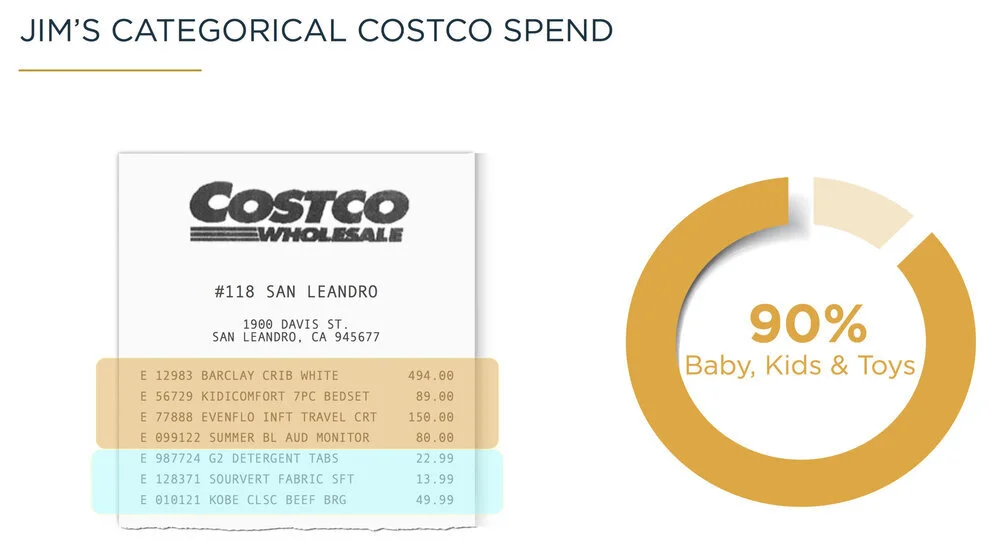

Each purchase produces a goldmine of information. Historically, banks have only been privy to “Level 1” purchase data. These data points – total amount, date, and merchant name, paint a vague and often misleading representation of a person. To really know a customer and contextualize offerings, banks need to know what their customers buy down to the item-level, or “Level 3" data.Take Jim and Mary, for example. They both spent $900 at Costco using their bank-issued credit card. Right now, this is the only information the bank has about both Jim and Mary’s Costco trips:Upon closer inspection, it is revealed that Jim has spent $900 on nursery furniture, baby care and groceries, which is far more revealing about Jim than simply knowing he spent $900 at Costco.Visibility into item-level receipt data means that banks can target Jim with products and incentives to support him as his financial needs evolve, such as a card with cash-back benefits for groceries and household goods, or perhaps a 529 Savings Plan for his newborn.On the other hand, Mary’s seemingly “similar” $900 Costco receipt paints a very different picture. Her purchases suggest she is furnishing an office, that she travels, and that she owns a car.Mary is more likely to accept an offer to upgrade to a business banking account, or perhaps a card with flight rewards or rebates for gas.Targeting offers based on item-level data improves the effectiveness of marketing campaigns, increases product holdings per customer and encourages card usage.

Predictive analytics will drive financial leadership

Knowing exactly what customers are buying over time means that banks can identify patterns about how their customers spend categorically. These patterns are indicative of more than just a person’s financial health - they’re clues to how a customer is changing and what their financial needs may be in the near future. In other words, it provides an opportunity for banks to position themselves to be there for their customers long-term. This is the power of predictive analytics.The patterns that emerge from item-level data allow banks to better understand their customers, predict their behaviour and generate actionable insights. The result? Optimized marketing budgets and bottom-line growth. Banks - it's time to adopt digital receipts as part of your mobile offerings.